Posts

The newest FTB web site have a map interesting prices essentially since the 1976. You can even contribute one add up to the state Parks Defense Fund/Areas Ticket Buy. To receive just one yearly park citation, the sum have to equivalent or go beyond $195.

When talks together with your property manager wear’t performs: Going to court

- Issuance out of Jetty Put and you may Jetty Include clients insurance coverage is actually at the mercy of underwriting remark and you will recognition.

- For no reason tend to such as a great withholding contract eliminate fees withheld to help you below the newest anticipated amount of income tax liability.

- See Private Characteristics, earlier, for the resource laws one implement.

- Direct deposit along with prevents the chance that the consider might possibly be forgotten, taken, lost, otherwise returned undeliverable to the Internal revenue service.

- When you are saying more three dependents, mount an announcement to your necessary centered information for the tax get back.

- Long-term financing obtain are an example of a certain sort of money that the highest income tax rates applies.

Making allowable benefits for yourself, you really must have web income of thinking-a career which might be effortlessly linked to your You.S. trading otherwise business. You could potentially subtract all the average and necessary expenses in the procedure of your own U.S. exchange otherwise team on the the amount they interact with income efficiently related to you to definitely trade otherwise organization. To have factual statements about most other company expenditures, check out Help guide to team expenses info. When you are a good nonresident alien processing Form 1040-NR, you might be able to use among the submitting statuses talked about later. If your partner died inside the 2022 otherwise 2023 and also you did perhaps not remarry before the prevent of 2024, you may also meet the requirements in order to document while the a good qualifying enduring partner and you will utilize the shared come back taxation costs. That it can be applied on condition that you will get registered a combined go back together with your companion to your year your spouse passed away.

Cullman, Morgan, Lawrence, Marion, and Winston Counties

The fresh regulations encompassing shelter deposits aren’t difficult to know, but they are very different greatly https://playcasinoonline.ca/paypal-bonus/ according to the state—or even the city. Entergy Arkansas people have fun with electronic services ahead of investing in they. For this reason, new customers may be needed to make a refundable defense put, that helps protect Entergy as well as users out of those who have fun with electricity and then leave without having to pay for it. Because the including losses connect with our very own consumers, the security deposit allows us to keep group’s costs off.

But not, if you are hitched and select in order to document a mutual get back which have a great You.S. citizen or resident mate, as the discussed less than Nonresident Spouse Handled as the a citizen within the part 1, you happen to be qualified to receive the credit. You must use in money all effortlessly linked focus earnings your receive otherwise which is credited for you personally inside seasons. Don’t remove it from the one punishment you must shell out to your a young withdrawal of a period checking account. Yet not, should your attention income is actually effectively associated with their You.S. change or team within the seasons, you can subtract on the web 18 from Agenda step 1 (Setting 1040) the degree of the first detachment punishment your financial business recharged.

You’ve got a twin-position income tax 12 months when you have already been one another a resident alien and you will an excellent nonresident alien in identical 12 months. Twin reputation cannot reference the citizenship; they pertains simply to your own tax resident reputation on the United Says. Inside the deciding their You.S. tax responsibility for a dual-position taxation seasons, additional regulations sign up for the new area of the year you are a citizen of your own All of us plus the part of the 12 months you’re an excellent nonresident.

If your USCIS or You.S. consular manager starts it commitment, their citizen reputation will be considered quit if final management acquisition of abandonment is actually provided. When you’re offered an attract a federal legal away from skilled legislation, a last judicial order is necessary. When processing by the send, you should send by the formal post, go back receipt requested (or even the international equivalent), and keep maintaining a copy and you can evidence it was shipped and you will gotten. When you’re each other an excellent nonresident and resident in identical seasons, you’ve got a dual status.

If your property manager hasn’t returned your bank account in the court timeframe, really claims enables you to sue her or him. And, if they are powering late, essentially landlords get rid of the authority to subtract funds from your deposit to own repairs. However, not one for the may seem if you wear’t deliver the property owner having a great forwarding target in writing whenever the fresh rent terminates. At the conclusion of the tenancy, specific says—in addition to Nyc—provide the to demand a great walkthrough of the flat together with your property owner. At the end, the fresh landlord should provide you which have a composed list of something you ought to resolve before you could move out to quit write-offs from your shelter put. An individual is actually possessing a few thousand bucks of one’s money under the guise from a great “defense deposit,” you must know every piece of information.

If you want to develop or change the designee’s agreement, check out ftb.california.gov/poa. Personal taxpayers can get consult one its refund be digitally placed on the more than one examining otherwise savings account. Including, you can request element of your own reimburse visit your examining account to utilize now plus the people for the checking account to save to own later.

A good taxpayer must document while the \”single\” if unmarried to your past day of the newest income tax year. Immediately after all of the classification has a get out of no in order to four, we become the brand new weighted mediocre to find the star get of a bank account. I weighing particular kinds, such as rates, far more heavily as opposed to others, such minimum opening places. Next, we mediocre for every financial unit along with her, and the borrowing union’s ethics score, to find the finally score on the borrowing partnership while the a entire. More resources for exactly how Business Insider’s personal finance team reviews and prices banking companies, borrowing unions, and you may banking points, browse the private financing article criteria.

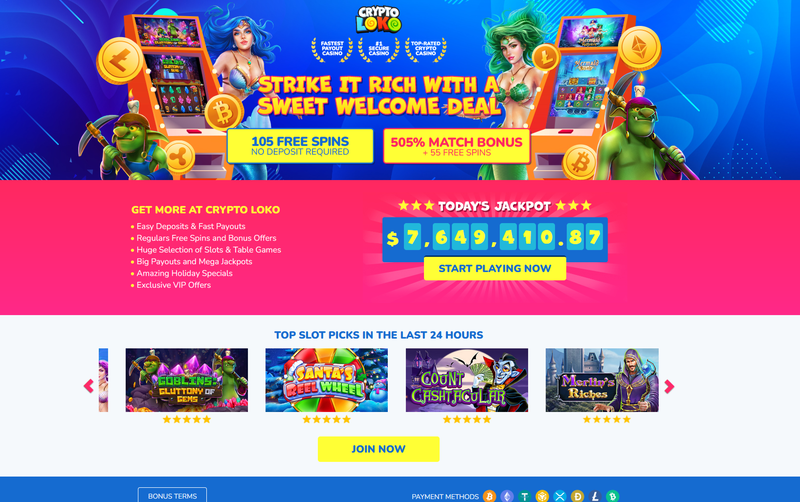

Delight look at your regional laws just before to play online in order to be sure you is actually lawfully allowed to participate by your many years and you may on your own jurisdiction. Yes, winning real cash is unquestionably a chance when you use zero deposit incentives to experience online slot machines. You can also gamble from the an online site among on line sweepstakes gambling enterprise real money United states of america for the majority says without needing people purchase and redeem honors for real money. Real money online casino betting try courtroom in the Nj, Michigan, Pennsylvania, Western Virginia and you can Connecticut.

Nonresident alien people of Barbados and you may Jamaica, in addition to students out of Jamaica, get be eligible for an election getting addressed since the a citizen alien for U.S. income tax motives underneath the You.S. income tax treaties with those people countries. For many who qualify for which election, you could make it by filing a form 1040 and you can attaching a finalized election declaration on the go back. The principles regarding the citizen aliens described in this book affect you. Just after generated, the new election is applicable providing you are nevertheless qualified, and you also need receive consent regarding the U.S. skilled power in order to terminate the newest election.

Simple mate relief

Compensation to own dependent private functions includes quantity paid off while the wages, wages, fees, bonuses, income, compensatory scholarships, fellowship income, and you will comparable designations to possess quantity paid off to help you a worker. Virgin Countries through your whole income tax year and you can performs briefly within the the united states, you ought to spend your income taxes for the U.S. Virgin Countries and you may document your earnings taxation statements at the after the address. Married dual-condition aliens can be allege the credit as long as it want to file a shared come back, because the talked about within the chapter step 1, or if perhaps it qualify since the specific hitched people lifestyle aside. If you have paid back, otherwise is liable for the new commission out of, tax to help you a foreign nation for the money out of international supply, you might be capable claim a cards to the foreign taxation. If you are a great nonresident alien who is a real resident away from American Samoa or Puerto Rico for the whole tax season, you are fundamentally taxed the same as citizen aliens.